Don't Overpay for Wealth Management

It's hard to determine how much to pay for wealth management. Most people hate overpaying and no one wants to be taken advantage of. Benjamin Franklin once overpaid as a boy and regretted it the rest of his life.

"When I was a Child of seven Years old … being charm'd with the Sound of a Whistle … I voluntarily offer'd and gave all my Money for it. When I came home, whistling all over the House … my Brothers, Sisters & Cousins … told me I had given four times as much for it as it was worth … and the Reflection gave me more Chagrin than the Whistle gave me Pleasure." — Benjamin Franklin

The Outdated 1% Rule

For wealth management, there's an old rule of thumb that fees are 1.00%. Frankly, that's out of date, especially for very wealthy individuals. I don't know if it was ever actually true. It has the ring of diamond companies spreading the myth of three months of salary for an engagement ring.

Fee Schedule Transparency

Lucky for us, the government requires registered investment advisors (RIAs) to publicly disclose their fee rates. Some firms, like Baker Street Advisors, give full fee schedules. We can use their fee schedule to calculate exactly what they charge per asset level.

Baker Street Advisors Fee Schedule

| Asset Range | Marginal Fee Rate |

|---|---|

| $0 - $4,000,000 | 0.75% |

| $4,000,001 - $15,000,000 | 0.50% |

| $15,000,001 - $25,000,000 | 0.40% |

| $25,000,001 - $50,000,000 | 0.35% |

| $50,000,001 - $75,000,000 | 0.30% |

| $75,000,001 - $100,000,000 | 0.25% |

| Above $100,000,000 | 0.20% |

Minimum Annual Fee: $25,000

I'll caveat that these are the "sticker prices." Similar to buying a car, most people negotiate a price below MSRP and pay their financial advisor a fee rate below the stated level.

It's great that some firms like Baker Street Advisors share their full fee schedule. Frustratingly, many RIAs are vague and don't give clear fee rates. It would be nice if the government forced these vague firms to clean up their act, but that hasn't happened yet and I don't expect it will in the near future either. As an example, Cerity Partners says their fee is negotiable and generally would not exceed 1.50% per year of assets under advisement.

Analysis of Actual Fee Rates

Advisors and Investors has used artificial intelligence to read thousands of the public filings where firms share their fee rates (called Form ADV Part 2A). You can view the full list of RIAs. Firms like Baker Street that share their full schedule are labeled "Robust Fee Schedule."

As you'll see, the majority of RIAs do not share the full schedule. Do not despair – there are still enough public fee rates available that you can at least get a sense of what competitors charge so you can avoid being a young Ben Franklin and paying 4x the worth of a services.

We looked at thousands of fee schedules. Some advisors, like WE Family Offices, charge a fixed fee instead of a percentage of assets, but they still base the initial fee off your level of assets and will typically raise your fixed fee if you have a large increase in assets. However, most firms charge a percentage of assets under management.

Actual Ultra-High-Net-Worth Fee Rates

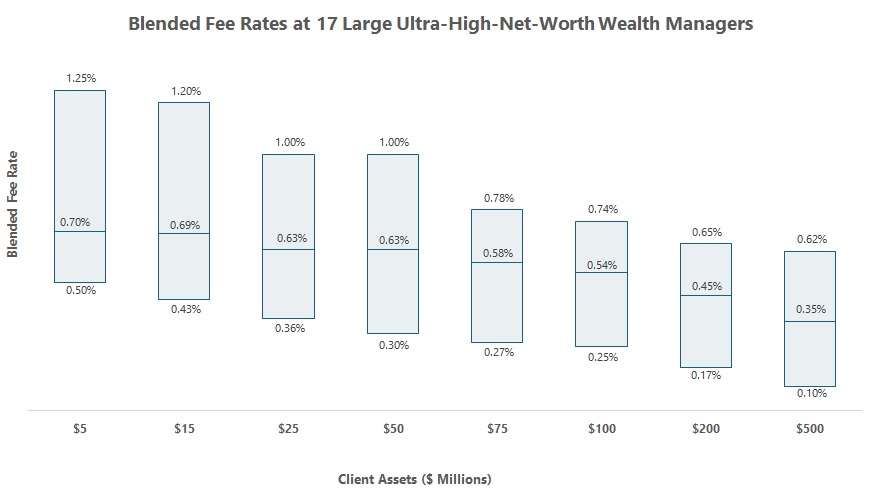

We've done an analysis of average stated fees on assets under management. We looked at 17 independent ultra-high net worth firms that share their full fee schedules. These firms are serving the ultra-rich – the median asset requirement to even consider being a client of this group is $5 million. One firm, Summit Rock Advisors, even has a stated $100 million client minimum (though I'd be pretty surprised if they are actually turning away $50 million prospects).

Analysis of fee rates across 17 ultra-high net worth wealth management firms

The biggest factor determining fees is how much money you have to invest. Fees are typically quoted as an annual percentage of "assets under management" (AUM). A 0.50% annual fee on $1 million is $5,000 per year, while the same rate of 0.50% on $10 million is $50,000 per year. Managing a $10 million account isn't actually 10 times more difficult than a $1 million one, so the percentage fee usually decreases at higher asset levels.

Remember Fees are Negotiable

One thing I really need to emphasize is WEALTH MANAGEMENT FEES ARE NEGOTIABLE. Every client should ask for lower fees. Many firms publicly list their fee schedules. Advisors and Investors makes it easy to find those fee schedules, so you can check how one firm compares with their competitors. Just remember, paying the stated fee rate is like buying a car for MSRP – a bit of negotiating can bring down the price significantly.

For expert strategies on how to negotiate lower fees, including when to ask, what discounts to expect, and how to position yourself as a valuable client, see our comprehensive guide on how to negotiate wealth management fees. You can also learn more about wealth management services in our guide on what wealth managers do and our comparison of different advisor types.